Learn how to pay off $10000 credit card debt fast with proven strategies like budgeting, debt snowball, balance transfers, and side hustles.

When I found myself staring at a $10,000 credit card balance, the weight of it felt overwhelming. The interest kept piling up, and it seemed like I was barely making a dent despite monthly payments. If you’re in a similar spot, wondering how to tackle a hefty credit card debt quickly.

I’ve been there, and I want to share practical strategies that worked for me and can work for you. Paying off $10,000 in credit card debt fast is challenging but entirely possible with a clear plan, discipline, and the right tools.

This guide is designed to meet your needs, whether you’re looking for motivation, financial strategies, or creative ways to boost your income. Let’s dive in and explore how you can take control of your finances and pay off that $10,000 credit card debt fast.

Understand Your Debt: The First Step to Freedom

Before I could make real progress, I had to face the numbers head-on. You need to know exactly what you’re dealing with, too. Start by listing all your credit card balances, interest rates (APRs), and minimum payments. For example, I had two cards: one with $6,000 at 22% APR and another with $4,000 at 18% APR. Seeing it written down helped me prioritize.

Why It Matters: High interest rates can double your debt over time if you only pay the minimum. For a $10,000 balance at 20% APR, paying $300 a month could take over four years and cost nearly $5,000 in interest. He or she who ignores the numbers risks staying trapped in a cycle of debt.

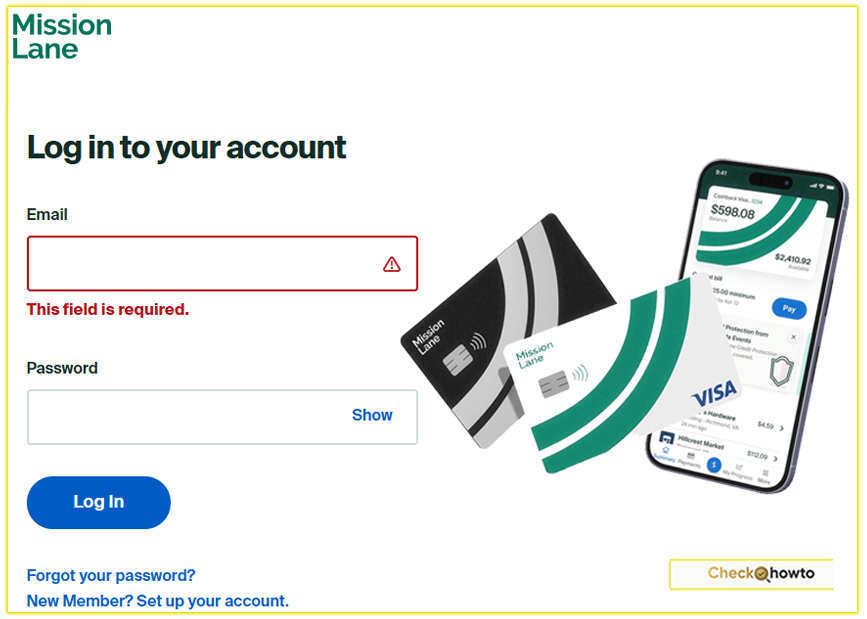

Action Step: Grab your statements or log into your accounts. Write down:

- Total balance per card

- Interest rate (APR)

- Minimum payment

- Due dates

Use a free debt payoff calculator online to estimate how long it’ll take to clear your balance with your current payments. This clarity sets the stage for smarter decisions.

Create a Budget You Can Stick To

I’ll be honest budgeting wasn’t my favorite thing at first. But once I started tracking my spending, I found extra cash to throw at my debt. You can do this, too. A budget is like a roadmap; it shows you where your money’s going and where you can cut back.

How I Did It: I used the 50/30/20 rule 50% of my income for essentials (rent, groceries), 30% for wants (dining out, subscriptions), and 20% for savings or debt repayment. I realized I was spending $100 a month on takeout, so I cut that to $50 and put the rest toward my credit card.

Tips for You:

- Track Spending: Use apps like Mint or YNAB to see where your money goes. She might be surprised to find small expenses adding up.

- Cut Non-Essentials: Cancel unused subscriptions, cook more at home, or switch to a cheaper phone plan. Every dollar saved is a dollar you can use to pay off debt.

- Set Realistic Goals: If you’re aiming to pay $500 a month toward debt, make sure your budget supports it without leaving you strapped.

Why It Works: Budgeting frees up cash to attack your debt faster. For example, redirecting $200 a month from “wants” to your credit card can shave months off your payoff timeline.

Choose a Debt Payoff Strategy: Snowball vs. Avalanche

When I decided to get serious, I needed a strategy to stay focused. Two popular methods the debt snowball and debt avalanche helped me decide how to tackle my $10,000. You’ll want to pick one that suits your personality.

Debt Snowball Method

This is the one I chose because I needed quick wins to stay motivated. With the snowball method, you pay off your smallest balance first while making minimum payments on others.

- How It Works: If you have a $1,000 balance and a $9,000 balance, focus extra payments on the $1,000 card. Once it’s paid off, roll that payment into the next card.

- Why I Loved It: Clearing my $4,000 card in six months gave me a huge boost. He or she who craves momentum will find this method rewarding.

- Pros: Builds motivation through quick wins.

- Cons: You might pay more interest since higher-rate debts wait.

Debt Avalanche Method

This method prioritizes the highest interest rate first, saving you money over time.

- How It Works: If your $6,000 card has a 22% APR and your $4,000 card has 18%, put extra cash toward the 22% card while paying minimums elsewhere.

- Why It’s Smart: You’ll pay less interest overall. For $10,000 at 20% APR, the avalanche could save hundreds compared to the snowball.

- Pros: Cost-effective in the long run.

- Cons: Slower visible progress if high-rate debts are large.

Your Choice: If you’re motivated by savings, go avalanche. If you need emotional wins, try Snowball. Either way, stick with it consistency is key.

Explore Balance Transfers to Save on Interest

One game-changer for me was transferring my balance to a 0% APR card. You might find this helpful, too, especially if your interest rates are eating up your payments.

What I Did: I moved $8,000 of my debt to a card with a 0% introductory APR for 18 months. There was a 3% transfer fee ($240), but I saved over $1,200 in interest by paying no APR during that period.

How It Works for You:

- Find a Card: Look for balance transfer cards with long 0% APR periods (12–21 months). Check sites like NerdWallet for options.

- Calculate Fees: A 3–5% fee is common, so weigh it against interest savings. For $10,000, a 3% fee is $300.

- Pay Aggressively: Divide your balance by the intro period months. For $10,000 over 18 months, that’s about $556 a month.

Caution: Don’t use the new card for purchases, as it could complicate payments. Also, pay off the balance before the intro period ends, or you’ll face high regular APRs (often 18–25%).

Why It Helps: A 0% APR lets every dollar go toward the principal, speeding up your payoff. She who uses this wisely can save thousands.

Consider Debt Consolidation for Simplicity

If you’ve got multiple cards, consolidating your debt into one loan might make things easier. I explored this when my payments felt scattered.

My Experience: I looked into personal loans but didn’t qualify for a low enough rate due to my credit score. Instead, I stuck with a balance transfer. But for you, consolidation could streamline your plan.

Options:

- Personal Loan: Combines debts into one fixed-rate loan, often at a lower rate than credit cards (6–15% vs. 20%+). For $10,000 at 10% over three years, you’d pay about $332 a month.

- Home Equity Loan: If you own a home, this offers lower rates (around 8%), but it risks your house if you can’t pay. I avoided this as it felt too risky.

- Debt Management Plan (DMP): Through a nonprofit credit counseling agency, a DMP negotiates lower rates and combines payments. Monthly fees apply, but it’s safer than settlement.

How to Choose: Compare loan rates using sites like Credible. If your credit is shaky, a DMP might be better. He who consolidates wisely simplifies life and saves money.

Boost Your Income to Pay Faster

I knew I couldn’t rely solely on cutting expenses, so I looked for ways to earn more. You can accelerate your payoff by bringing in extra cash.

What I Tried:

- Side Hustle: I started freelancing as a writer, earning $500 a month, which went straight to my debt.

- Sold Unused Items: Old electronics and clothes brought in $300 one weekend.

- Asked for a Raise: After six months of solid work, I got a 5% bump, adding $150 a month to my budget.

Ideas for You:

- Gig Economy: Drive for Uber, deliver for DoorDash, or pet-sit via Rover. Even 10 hours a week could net $200–$400 a month.

- Sell Stuff: Use eBay, Facebook Marketplace, or Poshmark for items you don’t need.

- Upskill: Take a course on Udemy to qualify for higher-paying work.

- Negotiate Pay: If you’ve been at your job a while, make a case for a raise.

Impact: Adding $300 a month to a $10,000 debt at 20% APR cuts payoff time from 50 months to 28, saving over $2,000 in interest. She who hustles sees results faster.

Negotiate with Creditors for Better Terms

I was nervous about calling my credit card company, but it paid off. You might be surprised what you can negotiate.

My Story: I asked for a lower APR on my $6,000 card. After explaining my commitment to paying off the debt, they dropped it from 22% to 17%, saving me $30 a month in interest.

Steps for You:

- Call Your Issuer: Be polite and honest. Say, “I’m working to pay off my balance and would appreciate a lower rate.”

- Ask About Hardship Programs: If you’re struggling, some issuers offer temporary rate reductions or payment plans.

- Work with a Counselor: A nonprofit agency like the National Foundation for Credit Counseling can negotiate on your behalf.

Why It Works: Even a 3% rate cut on $10,000 saves $300 a year. He who asks might just get relief.

Avoid Common Pitfalls

I learned the hard way that some “solutions” can backfire. Here’s what you should steer clear of:

- Minimum Payments Only: Paying just the minimum on $10,000 at 20% APR could take over 30 years and cost $20,000+ in interest.

- New Debt: Don’t use credit cards while paying off debt unless you can pay the balance monthly.

- Debt Settlement: This can tank your credit score and isn’t guaranteed. I avoided it after researching the risks.

- Raiding Savings: Keep a small emergency fund ($500–$1,000) to avoid falling back on cards.

Tip: Set up autopay for minimums to avoid late fees, then manually pay extra each month. She who plans ahead stays on track.

Stay Motivated and Celebrate Wins

Paying off $10,000 is a marathon, not a sprint. I kept myself going by celebrating small milestones. You can, too.

What Kept Me Going:

- Visual Tracker: I made a chart and colored in each $1,000 paid-off. Seeing progress was huge.

- Rewards: After paying off my first card, I treated myself to a $20 movie night guilt-free.

- Support: I joined online forums like Reddit’s r/debtfree to share tips and encouragement.

Your Turn:

- Track progress with apps like Debt Payoff Planner.

- Reward yourself modestly for a coffee or a walk in the park.

- Tell a friend your goal for accountability.

Why It Matters: Motivation keeps you from giving up. He who celebrates small wins builds momentum.

Final Thoughts: You Can Do This

Paying off $10,000 in credit card debt fast isn’t easy, but it’s within your reach. I went from feeling crushed to debt-free in two years by budgeting, using a balance transfer, and hustling for extra income. You can create your own path by choosing strategies that fit your life whether it’s the snowball method, consolidation, or negotiating rates. Start today by assessing your debt and making a plan. Every step forward is a step toward financial freedom.

Share your progress with someone you trust it makes the journey lighter. What’s your first step going to be?