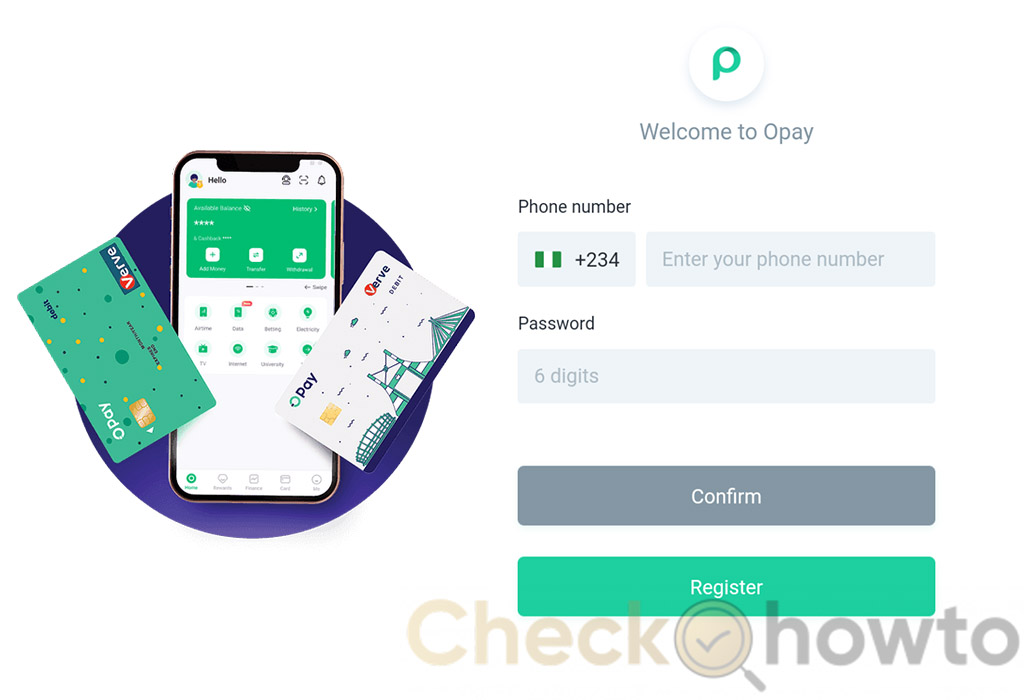

Opay is a digital payment platform that enables its users to make payments for goods and services. With Opay, you can access different features and services like ordering food, booking rides, and making investments.

Creating an Opay account is easy, and we will show you in this guide how to start enjoying the advantages of an Opay account.

The Benefits of Using Opay for Mobile Payments

With Opay, the perks are to keep going. If you open an Opay account, you’ll enjoy some benefits while making mobile payments.

- With just a few taps on your phone, you can pay for goods and services online and offline.

- Instantly send and receive funds to users with an Opay account and other bank accounts.

- You can make transactions without incurring high processing fees when you use pay.

- The OPay app helps its users to manage spending and finances easily.

- The OPay app allows you to access ORide, OFood, OWealth, and more services.

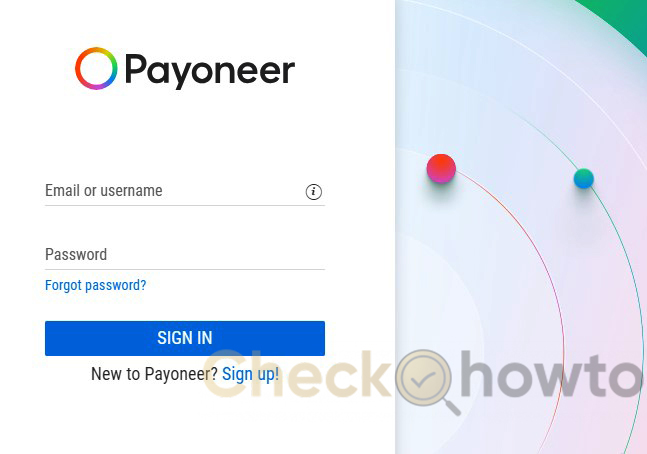

A Step-by-Step Guide on How to Open an Opay Account

To open an Opay account, follow these easy steps:

- Download the Opay app from your respective app store [i.e., Google Play Store or Apple App Store].

- After installing the app, open it and tap “Create Account.”

- Please enter your phone number and verify it with a code sent via SMS.

- Set a six-digit PIN for your account.

- Enter your personal information, such as your name, email address, date of birth, gender, and state of residence.

- Upload a clear photo of yourself.

After you have completed the steps, you should have successfully created your OPay account.

Verifying your Opay Account

To enjoy the full features and benefits of Opay, you need to verify your Opay account. Some benefits of verifying your Opay account are increased transaction limits and a more secure account to protect your account from.

- Open the Opay app and enter your 6-digit password.

- Click on the “Me” icon at the app’s bottom right corner.

- Tap on “KYC & Security.”

- Tap on “Verify Identity.”

- Choose your ID type and enter your ID number.

- Upload a clear photo of your ID card and a selfie holding your ID card.

- Tap on “Submit” and wait for approval.

Follow these steps, and you should successfully verify your Opay account to enjoy the benefits of the OPay app.

Adding Funds to your Opay Wallet

To start making payments with Opay, you need to fund your Opay wallet. There is more than one way to fund your account:

- Bank transfer: Using the app, you can transfer money from your account to your Opay wallet. Use your unique account number to transfer from your bank app or USSD code.

- Card: You can fund your Opay wallet using your debit or credit card. Just enter the amount you want to send and enter your card details.

- Agent: Opay agents around your location can help fund your Opay wallet. Give the agent the cash to add to your Opay wallet. Then, Scan the agent’s QR code or enter their phone number.

Making Mobile Payments with Opay

Your Opay wallet can pay for goods and services online and offline. Here are some ways you can use Opay to make mobile payments.

- Paying bills: The Opay app makes payments for utilities, airtime, data, cable TV, electricity, education, and insurance easier. Select the service you want to pay for and enter the information required and the amount you wish to pay.

- Paying merchants: You can purchase goods and pay for services at any merchant that accepts Opay. Just scan the merchant’s QR code or enter their phone number and the amount you want to pay.

- Sending money: You can send funds to anyone with an Opay or bank account. Choose “To Opay” or “To Bank“. Input the recipient’s phone number or account number and name. Enter the amount you want to send.

Opay’s Additional Features and Services

Opay has a lot of bonus features and services that come with it. Here are some of the features and their uses:

- ORide: Book a motorcycle or a car for your transportation needs.

- OFood: Order food from your favourite restaurants and deliver it to your doorstep.

- OWealth: Create savings plans, invest in mutual funds, and buy insurance with Opay.

- OBet: Place bets on various sports events and games with Opay.

- OTravel: Book flights, hotels, and tickets with Opay.

To use these features and services on the Opay app, tap the icons on the app’s home screen and follow the on-screen instructions.

Troubleshooting Common Issues with Opay

When using Opay, you might need help with issues like failed transactions, delayed notifications, missing funds, or forgotten PINs. Troubleshooting them is easy if you follow the steps below:

- Failed transaction: Check your transaction status in the app. If the transaction is pending, wait a few minutes for it to complete. If your transaction fails, try again or contact customer service.

- Delayed Notifications: Check your phone settings and ensure Opay notifications are turned on. Please check your internet connection and make sure it is stable. If you still don’t receive a notification, please contact customer service.

- Missing funds: Check your transaction history in the app. If your transaction was successful, but you don’t see the funds in your wallet or account, please contact customer service.

- Forgot your PIN? Reset your PIN in the app. Enter your phone number and confirm using the code sent via SMS. Set a new PIN for your account.

Security Measures and Protecting Your Opay Account

You need to take some steps to keep your Opay account safe.

- Keep your PIN to yourself: Your Personal Identification Number (PIN) should be private. Do not share your PIN with your family or pay agent.

- Answer Security questions: This is essential when someone tries to gain access to your account from another device. It helps to determine if you are trying to gain access to your account.

- Make transactions discreet: Make sure no one can see your phone when you are making a transaction.

How to Request for an Opay Card?

To apply for an Opay debit card, follow these guides below:

- Login to your pay app.

- Tap on My Profile Fill the required information on the form for the request for an Opay debit card.

- Select your desired pick-up location.

- Fill in the needed information in the spaces provided.

Note that the application charge for an Opay debit card should be around 500 naira to 1000 naira.

Is it Advisable to use Opay?

Opay is fully insured by the Nigeria Deposit Insurance Corporation (NDIC). So it is entirely safe to keep your money with Opay.

Opay is no doubt one of the best mobile wallets available in Nigeria. Using Opay has a lot of benefits, like a secure account, reduced transaction fees, and more. Join Opay to enjoy all these and more.

Related Post;