As someone who’s navigated the world of credit cards, I understand the appeal of consolidating debt to save on interest. If you’re considering a balance transfer with the Costco Anywhere Visa® Card by Citi, I’m here to walk you through the process, benefits, and potential pitfalls.

This guide aims to help you make an informed decision, ensuring you have all the details to manage your finances effectively.

What Is a Balance Transfer?

A balance transfer involves moving debt from one credit card (or other types of loans) to another, typically to take advantage of a lower interest rate or promotional offer. I’ve found balance transfers to be a smart strategy when you’re dealing with high-interest debt, as they can reduce the interest you pay over time. For you, the goal might be to simplify payments or save money, but it’s crucial to understand the terms before proceeding.

With the Costco Anywhere Visa® Card, balance transfers are possible, but they come with specific conditions. Unlike some cards that offer a 0% introductory APR, this card doesn’t provide such a perk, which is something I learned when researching my own debt consolidation options. Let’s explore how it works and whether it’s the right choice for you.

How Does the Costco Credit Card Balance Transfer Work?

The Costco Anywhere Visa® Card by Citi allows balance transfers, but you need to act within two months of opening your account. I discovered this when I considered transferring a balance from another card to consolidate my payments. Here’s how you can initiate a balance transfer:

- For New Applicants: When applying for the Costco card, you’ll see a section to input the account number and amount you want to transfer. You’ll also provide standard details like your name, Social Security number, and income. I found this process straightforward when I applied for a similar card, but double-check your entries to avoid errors.

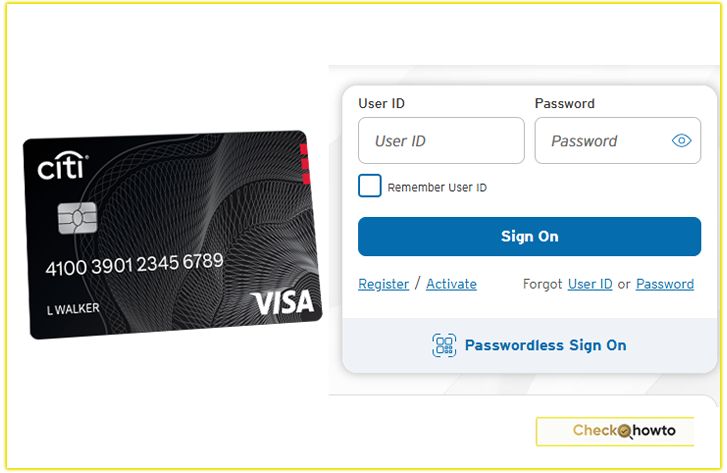

- For Existing Cardholders: If you already have the card, log into your Citi account online or call customer service at (800) 950-5114 to request a transfer. You’ll need the account number of the debt you’re transferring and the amount. When I did this with another card, I appreciated the online portal’s ease, but calling can be quicker if you have questions.

The transfer typically takes 14 days to process, so you should continue making payments on your original debt to avoid late fees or credit score damage.

I learned this the hard way once, racking up a small late fee because I assumed the transfer was instant. Don’t make my mistake—stay proactive with payments.

Types of Debt You Can Transfer

You can transfer balances from various sources, including:

- Other credit cards (except Citi accounts)

- Mortgage payments

- Home equity loans

- Store credit cards

- Auto loans

This flexibility surprised me, as I initially thought balance transfers were limited to credit cards. However, you can’t transfer balances from other Citi cards, which is a limitation to keep in mind.

Costs and Fees Associated with Costco Credit Card Balance Transfer

One of the first things I check with any balance transfer is the cost. For the Costco credit card Anywhere Visa®, the balance transfer fee is 5% of the transferred amount, with a minimum of $5. For example, if you transfer $2,000, you’ll pay a $100 fee. When I calculated this for my own debts, I realized the fee could add up, so you’ll want to factor it into your savings plan.

The variable APR for balance transfers ranges from 19.49% to 27.49%, based on your creditworthiness. Unlike cards with 0% intro APR offers, the Costco card starts charging interest immediately after the transfer, with no grace period unless you pay off the full balance each month.

I found this less appealing compared to other cards I’ve used, like the Citi® Diamond Preferred® Card, which offers a 0% intro APR for 21 months on balance transfers.

Additionally, if you miss a payment or it’s returned, a penalty APR of up to 29.99% may apply. I’ve been cautious about this since a late payment once spiked my interest rate on another card, costing me more than expected. You should set up payment reminders to avoid this.

Pros and Cons of Using the Costco Card for Balance Transfers

When I evaluated the Costco card for a balance transfer, I weighed the benefits against the drawbacks. Here’s what you need to know:

Pros

- No Annual Fee: As long as you maintain a paid Costco membership (starting at $60/year), there’s no additional card fee. This was a plus for me since I’m already a Costco member.

- Cash Back Rewards: You earn 5% cash back on gas at Costco (4% elsewhere, up to $7,000/year), 3% on restaurants and travel, 2% on Costco purchases, and 1% on everything else. I love earning rewards on everyday spending, and you might find this adds value if you shop at Costco frequently.

- No Foreign Transaction Fees: If you travel, this is a perk. I’ve saved money using similar cards abroad without those extra charges.

- Flexible Debt Sources: The ability to transfer non-credit card debt (like auto loans) is a unique feature that might suit your needs.

Cons

- No 0% Intro APR: The lack of a promotional rate makes this card less competitive for balance transfers. I opted for a different card with a 0% intro period to save on interest.

- High Balance Transfer Fee: The 5% fee (minimum $5) is steeper than some cards offering 3% or lower. You’ll need to calculate if the fee outweighs your interest savings.

- Interest on Retail Purchases: If you carry a balance transfer, even paying off new purchases monthly might not prevent interest charges on those purchases. I found this confusing when I read user experiences on Reddit, where a cardholder noted interest accruing despite paying retail charges in full.

- Membership Requirement: You need a Costco membership, which starts at $60. If you’re not a member, this adds to the cost.

How I Login to My Costco Credit Card Account

Is the Costco Credit Card Balance Transfer Right for You?

Deciding whether to use the Costco card for a balance transfer depends on your financial goals. I’ve found that balance transfers work best when you can save significantly on interest. Since the Costco card lacks a 0% intro APR, it’s not ideal for most balance transfer scenarios.

For example, transferring $5,000 would incur a $250 fee and immediate interest at 19.49% or higher, compared to a 0% intro card where you’d only pay a 3–5% fee for 12–21 months.

However, if you’re a loyal Costco shopper and already have the card, consolidating smaller debts might make sense, especially if you can pay them off quickly.

I considered this for a small store card balance but chose a 0% intro card instead for larger savings. You should use a balance transfer calculator (like the one on WalletHub) to compare costs and ensure the transfer aligns with your budget.

Alternatives to Consider

If the Costco card’s terms don’t suit you 8f3e you, I recommend exploring these alternatives, which I’ve found more cost-effective for balance transfers:

- Citi® Diamond Preferred® Card: Offers 0% intro APR for 21 months on balance transfers, with a 3% fee for transfers within four months.

- Chase Freedom Unlimited®: Provides 0% intro APR for 15 months on purchases and balance transfers, with a 3–5% fee.

- Wells Fargo Active Cash® Card: Features 0% intro APR for 12 months on balance transfers, with a 3–5% fee.

These cards often require a credit score of 700 or higher, so check your score before applying. I always pull my credit report to ensure I qualify, and you should too for the best approval odds.

Tips for a Successful Balance Transfer

To maximize your savings and avoid pitfalls, follow these tips, which I’ve refined through my own experiences:

- Pay During Processing: Continue payments on your original debt until the transfer completes to avoid late fees.

- Calculate Total Costs: Include the transfer fee and potential interest in your budget. I use online calculators to estimate savings.

- Pay Off Before Regular APR: If you choose a 0% intro card, aim to clear the balance before the promotional period ends to avoid high interest.

- Avoid New Purchases: New purchases on the Costco card may accrue interest if you carry a transferred balance, so use another card for spending.

- Monitor Your Credit: A balance transfer can slightly lower your score due to a hard inquiry or higher credit utilization. I check my score monthly to stay on track.

Final Thoughts

The Costco Anywhere Visa® Card by Citi offers a balance transfer option, but its 5% fee and lack of a 0% intro APR make it less appealing for most debt consolidation needs.

As someone who’s juggled credit card debt, I’d steer you toward cards with promotional rates unless you’re a Costco devotee with a small balance to transfer. By understanding the costs, comparing alternatives, and planning your payments, you can make a decision that boosts your financial health.

For the latest details, visit Citi.com or contact Costco customer service.