When I first considered applying for a credit card, I was overwhelmed by the options and the fear of rejection. If you’re in a similar boat, especially with a less-than-perfect credit score, the Aspire Credit Card pre-approval process might be the lifeline you need.

As someone who’s navigated the world of credit rebuilding, I’m here to walk you through what Aspire’s pre-approval entails, why it’s a smart move, and how you can take advantage of it. This guide is designed to be your go-to resource, blending my personal insights with practical steps to help you make an informed decision.

What Is Aspire Credit Card Pre-Approval?

The Aspire Credit Card, issued by The Bank of Missouri, is tailored for individuals with bad credit (typically a credit score of 550–650). The pre-approval process is a game-changer because it lets you check your eligibility without risking a hit to your credit score.

When I first heard about this, I was skeptical—how could a company tell me if I qualify without digging into my credit report? The answer lies in the soft inquiry, a gentle peek into your credit history that doesn’t leave a mark.

Here’s how it works: you visit the Aspire website (apply.aspire.com) and fill out a form with basic details like your name, address, Social Security number, income, and employment status. This takes just a few minutes, and Aspire uses this info to assess whether you’re a good fit for their unsecured credit card.

Unlike a full application, which triggers a hard inquiry that can ding your score, pre-approval is risk-free. If you’re pre-approved, you’ll receive an offer—sometimes with a 14-digit acceptance code—detailing your potential credit limit, APR, and fees. If you like what you see, you can proceed with the full application, which does involve a hard inquiry.

Why this matters for you

If you’re rebuilding credit, every point on your score counts. The pre-approval process gives you clarity without the stress, helping you decide if the Aspire Card aligns with your financial goals.

Why Choose the Aspire Credit Card?

I’ve learned that not all credit cards are created equal, especially for those of us with fair credit or bad credit. The Aspire Card stands out for a few reasons, and understanding these can help you decide if it’s worth pursuing pre-approval.

Key Features of the Aspire Card

- No Security Deposit: Unlike secured credit cards, Aspire’s unsecured card doesn’t require an upfront deposit, giving you immediate purchasing power with a starting credit limit of at least $350.

- Cash Back Rewards: The Aspire Cash Back Rewards Mastercard offers 3% cash back on eligible gas, grocery, and utility purchases and 1% on other eligible purchases. This was a pleasant surprise for me, as rewards are rare for subprime cards.

- Free Credit Score Access: After 60 days, you can view your VantageScore 4.0 from TransUnion in your online account. I found this helpful for tracking my credit-building progress.

- Fraud Protection: With zero fraud liability under Mastercard rules, you’re protected from unauthorized charges, which gave me peace of mind.

- Credit Building: Aspire reports to all three major credit bureaus (TransUnion, Experian, Equifax), so your on-time payments can boost your score over time. This was a big win for me as I worked to improve my credit.

Who It’s For

The Aspire Card is ideal if you have less-than-perfect credit and want a card to help rebuild your financial standing. It’s not for everyone—those with excellent credit might find better options with lower fees and higher rewards. But if you’re like me, starting from a low point (my score was in the 500s), this card can be a stepping stone.

How to Check for Aspire Pre-Approval

Ready to see if you qualify? Here’s a step-by-step guide based on my experience and Aspire’s process:

- Visit the Aspire Website: Head to apply.aspire.com and click “See if you qualify.” This is where the pre-approval magic begins.

- Fill Out the Form: Provide your personal details—name, address, Social Security number, income, and employment info. Be honest; Aspire uses this to tailor your offer. I double-checked my entries to avoid errors.

- Review the Disclaimer: Before submitting, read the terms. Aspire notes that pre-approval involves a soft pull and that final approval depends on meeting criteria like proof of income.

- Submit and Wait: After clicking “View Offer,” you’ll quickly learn if you’re pre-approved. If approved, you’ll get an acceptance code and details like your potential credit limit (up to $1,000) and APR.

- Decide to Apply: If you like the offer, proceed with the full application. This triggers a hard pull, so weigh the terms carefully. I took a day to review the fees and APR before moving forward.

Pro Tip: If you received a mail offer with an acceptance code, visit https://www.aspirecreditcard.com and enter the code to streamline the process.

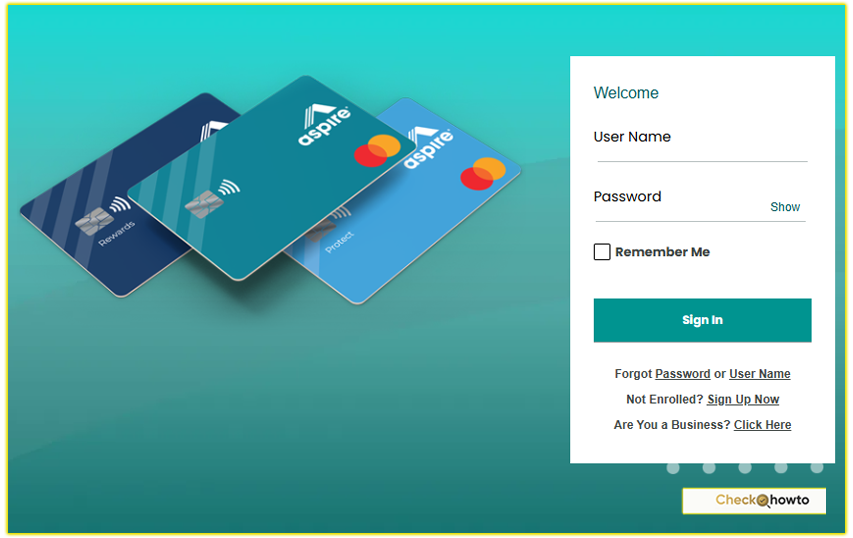

How I Login to My Aspire Credit Card Account

Pros and Cons of the Aspire Credit Card

No card is perfect, and the Aspire Card has its share of strengths and weaknesses. Here’s what I’ve learned, so you can make an informed choice:

Pros

- Accessible for Bad Credit: With a minimum credit score requirement of around 500, it’s easier to qualify than many cards.

- No Initial Deposit: You get a credit line without tying up your cash, unlike secured cards.

- Rewards Program: Earning 3% cash back on essentials like gas and groceries is a nice perk for a subprime card.

- Online Account Management: The Aspire Account Center lets you manage your card 24/7 via desktop or the Aspire mobile app. I found the app clunky but functional for checking balances and making payments.

- Credit Score Monitoring: Free access to your VantageScore helps you track progress.

Cons

- High Fees: The annual fee ranges from $85–$175 in the first year, plus monthly maintenance fees after that. This ate into my rewards early on.

- High APR: Expect an APR of 29.9%–36%, which can be costly if you carry a balance. I always paid in full to avoid interest.

- Low Credit Limit: Starting at $350, the limit is modest, though it may increase with good payment history.

- Mixed Customer Reviews: Some users report issues like account closures without notice or poor customer service. I haven’t faced this, but it’s worth noting.

Tips for Maximizing Your Aspire Card

If you get pre-approved and decide to apply, here’s how to make the most of the Aspire Card, based on my experience:

- Pay on Time: On-time payments are reported to credit bureaus, helping your score. I set up autopay to avoid missing due dates.

- Keep Balances Low: Aim to use less than 30% of your credit limit (e.g., $105 on a $350 limit) to improve your credit utilization ratio.

- Leverage Rewards: Use the card for gas, groceries, and utilities to earn 3% cash back, but don’t overspend just for rewards.

- Monitor Your Score: Check your VantageScore regularly in the Aspire Account Center to track improvements.

- Contact Customer Service if Needed: Reach Aspire at 1-855-802-5572 for issues. I found their support responsive when I had a billing question.

Is the Aspire Card Right for You?

Deciding whether to pursue Aspire Credit Card pre-approval depends on your financial situation. If you’re rebuilding credit and need an unsecured card with rewards, Aspire is worth considering.

The pre-approval process is low-risk, letting you explore your options without harming your score. However, the high fees and APR mean you’ll need to be disciplined about paying off your balance each month.

For me, the Aspire Card was a stepping stone. My credit score climbed from the low 500s to nearly 700 in a year, thanks to consistent payments and careful use. But I also explored other options like secured credit cards from Discover or Capital One, which might suit you if you want lower fees.

Final Advice: Before applying, check your credit score for free on sites like WalletHub to confirm you’re in Aspire’s target range (500+). Compare the Aspire Card to alternatives, and only proceed if the terms fit your budget.

Conclusion

The Aspire Credit Card pre-approval process is a user-friendly way to explore your eligibility without risking your credit score. By offering a glimpse into your potential offer, Aspire empowers you to make a smart choice.

My journey with the card wasn’t perfect—those fees stung—but it helped me rebuild my credit when few other options were available.

If you’re ready to take control of your financial future, visit apply.aspire.com to see if you pre-qualify. With careful use, this card can be a tool to unlock better opportunities down the road.

Disclaimer: Terms and conditions apply. Approval is subject to creditworthiness and other criteria. Always review the full terms on Aspire’s website before applying.