When it comes to securing a mortgage, I know how overwhelming the process can feel. Whether you’re a first-time homebuyer or looking to refinance, understanding your options is crucial. That’s why I’ve decided to dive deep into Arvest Bank’s mortgage offerings to help you make an informed decision.

I’ll walk you through everything you need to know about Arvest Bank mortgages, from their loan programs to their servicing center and how to get pre-qualified. By the end, you’ll have a clear picture of whether Arvest Bank is the right choice for your home financing needs.

Who Is Arvest Bank?

Arvest Bank is a community-focused financial institution serving customers in Arkansas, Kansas, Missouri, and Oklahoma. With a history dating back to 1961, Arvest has built a reputation for providing personalized banking solutions, including mortgages, to its customers. Their commitment to customer service and local communities makes them a trusted choice for home loans.

Why Choose Arvest Bank for Your Mortgage?

Why does Arvest Bank stand out in the crowded mortgage market? As someone who values transparency and customer service, I appreciate that Arvest Bank has built a reputation for offering competitive rates, flexible loan programs, and a user-friendly experience. Whether you’re looking for a conventional loan, an FHA loan, or even a VA loan, Arvest Bank has options to suit your needs.

One of the things I love about Arvest Bank is their commitment to education. Their Home4Me program is a fantastic resource for first-time homebuyers, offering tools and guidance to help you navigate the homebuying process with confidence. If you’re feeling unsure about where to start, this program is a great place to begin.

Here’s why you might want to consider them for your home loan:

- Local Expertise: Arvest Bank understands the housing markets in the regions they serve, which means they can offer tailored advice and solutions.

- Wide Range of Mortgage Programs: Whether you’re buying your first home, building a new one, or refinancing, Arvest has a program to fit your needs.

- Competitive Rates: Arvest Bank offers competitive mortgage rates, which can save you money over the life of your loan.

- Customer-Centric Approach: Their focus on customer satisfaction ensures a smooth and supportive mortgage process.

Arvest Credit Card: Everything You Need to Know

Arvest Bank Mortgage Programs

One of the things I appreciate most about Arvest Bank is the variety of mortgage programs they offer. Let’s break down the options so you can determine which one aligns with your goals.

1. Conventional Loans

- What It Is: A conventional loan is a popular option for homebuyers who meet standard credit and income requirements.

- Who It’s For: If you have a strong credit score and a stable income, this could be the right choice for you.

- Benefits: Lower interest rates and flexible terms make conventional loans a great option for many buyers.

2. FHA Loans

- What It Is: Backed by the Federal Housing Administration, FHA loans are designed for buyers with lower credit scores or smaller down payments.

- Who It’s For: First-time homebuyers or those with limited savings may find this program particularly helpful.

- Benefits: Lower down payment requirements and more lenient credit qualifications.

3. VA Loans

- What It Is: VA loans are available to veterans, active-duty service members, and eligible spouses.

- Who It’s For: If you’ve served in the military, this program offers significant benefits.

- Benefits: No down payment is required, and there’s no private mortgage insurance (PMI).

4. USDA Loans

- What It Is: USDA loans are designed for homebuyers in rural areas.

- Who It’s For: If you’re looking to buy a home in a qualifying rural area, this program could be a perfect fit.

- Benefits: No down payment and low interest rates make USDA loans an attractive option.

5. Jumbo Loans

- What It Is: Jumbo loans are for homebuyers who need to borrow more than the conforming loan limits.

- Who It’s For: If you’re purchasing a high-value property, this program can help.

- Benefits: Higher loan amounts and competitive rates.

6. Construction Loans

- What It Is: If you’re building a new home, Arvest Bank offers construction loans to finance the project.

- Who It’s For: Homebuyers who want to customize their home from the ground up.

- Benefits: Flexible terms and the ability to convert the loan into a permanent mortgage after construction.

How to Apply for an Arvest Bank Mortgage

Now that you know about the different mortgage programs, let’s talk about the application process. I’ll guide you through the steps so you know what to expect.

1: Pre-Qualification

- What It Is: Pre-qualification gives you an estimate of how much you can borrow based on your financial situation.

- How to Do It: You can start the process online through Arvest Bank’s pre-qualification tool.

- Why It’s Important: Pre-qualification helps you set a budget and shows sellers that you’re a serious buyer.

2: Choose a Mortgage Program

- What to Consider: Think about your financial goals, credit score, and down payment amount.

- How Arvest Can Help: Their loan officers can guide you in selecting the right program for your needs.

3: Submit Your Application

- What You’ll Need: Gather documents like pay stubs, tax returns, and bank statements.

- How to Apply: You can apply online or visit a local branch for in-person assistance.

4: Loan Processing and Underwriting

- What Happens: Arvest Bank will verify your information and assess your eligibility.

- How Long It Takes: The timeline can vary, but their team works efficiently to keep the process moving.

5: Closing

- What to Expect: Once approved, you’ll sign the final paperwork and receive the keys to your new home.

- How Arvest Supports You: Their team will guide you through every step to ensure a smooth closing.

Arvest Bank Mortgage Rates

One of the most important factors to consider when choosing a mortgage is the interest rate. Arvest Bank offers competitive rates that are updated regularly on their rates page. I suggest checking this page frequently, as rates can fluctuate based on market conditions.

Keep in mind that your interest rate will depend on several factors, including your credit score, loan amount, and down payment. If you’re looking to secure the best rate possible, I recommend working on improving your credit score and saving for a larger down payment.

The Arvest Bank Servicing Center

Once you’ve secured your mortgage, you’ll interact with Arvest Bank’s Servicing Center. This is where you’ll manage your loan, make payments, and access resources to help you stay on track. I found the Servicing Center to be incredibly user-friendly, with options to pay online, set up automatic payments, and even speak with a representative if you have questions.

If you ever need to find a lender or have questions about your loan, the Find a Lender tool on Arvest Bank’s website is a great resource. It allows you to connect with local lenders who can provide personalized assistance.

Tips for a Smooth Mortgage Process

Based on my research and experience, here are a few tips to ensure a smooth mortgage process with Arvest Bank:

- Get Your Documents in Order: Before applying for a mortgage, gather all the necessary documents, including pay stubs, tax returns, and bank statements. This will help speed up the approval process.

- Check Your Credit Score: Your credit score plays a significant role in determining your interest rate and loan eligibility. If your score is lower than you’d like, take steps to improve it before applying.

- Explore Down Payment Assistance Programs: If you’re struggling to save for a down payment, look into programs that offer assistance. Arvest Bank’s Home4Me program is a great place to start.

- Ask Questions: Don’t hesitate to reach out to Arvest Bank’s customer service team if you have any questions or concerns. They’re there to help you every step of the way.

Frequently Asked Questions

Can I apply for an Arvest Bank mortgage online?

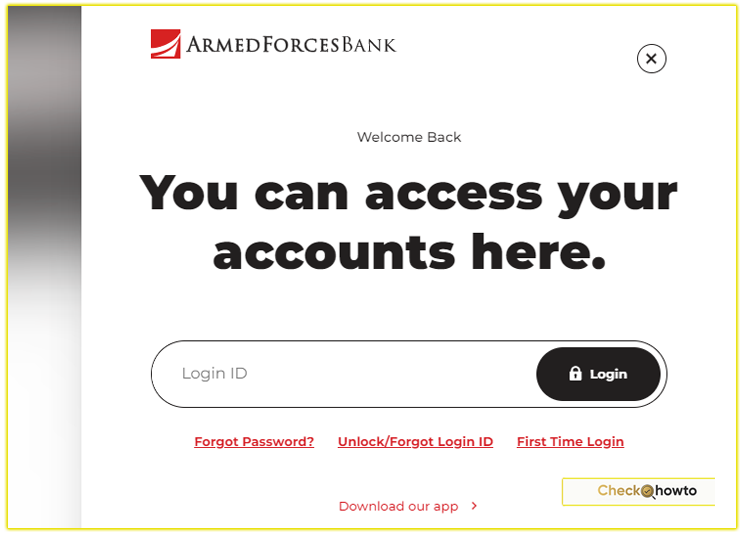

Yes, you can start the application process online through their mortgage portal.

What is the minimum credit score required?

The minimum credit score varies by program, but Arvest Bank offers options for borrowers with lower scores.

How long does it take to get approved?

The timeline depends on factors like your financial situation and the program you choose, but Arvest Bank strives to make the process efficient.

Can I refinance my existing mortgage with Arvest Bank?

Absolutely! Arvest Bank offers refinancing options to help you lower your interest rate or change your loan terms.

What if I have trouble making payments?

Arvest Bank’s Mortgage Servicing Center offers assistance programs for borrowers facing financial difficulties.

Final Thoughts

Navigating the mortgage process can feel daunting, but with Arvest Bank, you’re in good hands. Their wide range of programs, competitive rates, and customer-focused approach make them a top choice for homebuyers and refinancers alike. Whether you’re just starting to explore your options or ready to apply, Arvest Bank has the tools and expertise to guide you every step of the way.

If you’re ready to take the next step, visit their home loans page to learn more or start your application today. Remember, buying a home is one of the most significant financial decisions you’ll make, so take your time, ask questions, and choose the option that best fits your needs.