Opening an account can be quite stressful if you do not know the procedures involved. You will need some guidelines when opening an account, as this will make the process easy.

So, if you intend to open an Access bank account, the guidelines below will help you open a hassle-free account.

An Access bank Account is an easy and inexpensive transaction account that offers access to helpful banking channels.

The access bank account allows you to bank in your community and access mobile phone banking, Internet banking, and the Mobile App, allowing you to bank anywhere at any time.

Types of Access Bank accounts

Access banks have different types of bank accounts. Let us take a look at these other accounts.

- Black Card.

- Business Advantage.

- Corporate account.

- DBA account.

- Domiciliary account.

- Evergreen Account.

- Everyday banking.

- Exclusive private banker.

- Home Invest.

- Money transfer.

- Solo account.

These are the types of accounts that Access Bank provides its users.

Benefits of Opening an Access Bank Account

Opening an access bank account comes with lots of benefits. Some of these benefits of opening an Access account are outlined below.

- There is no opening balance.

- A minimum balance is not required.

- No account maintenance fee is required.

- Maximum monthly turnover is not required.

- There is the availability of a chequebook.

- A Naira credit card is also available.

- You get access to a Debit Card based on your preference.

- You can access alternate online, mobile, and telephone banking channels.

- Permit direct debit instructions.

- Third-party transactions are authorized.

- You can access personal loans, advances for school fees, vehicle finance, mortgage, M.H.S.S., etc.

- Your other transactions are charged at an approved rate.

These are the benefits that come with opening an Access bank account.

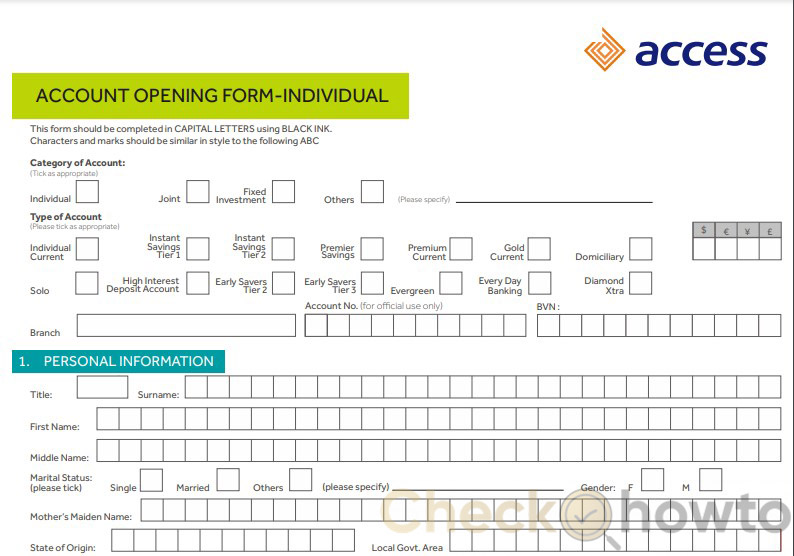

Documents Required to Open an Access Bank Account

What are the documents you will need when opening an Access bank account? This is a question most people ask. You must take the documents to the bank if you do not have them.

Opening an account will be frustrating, so we have listed the documents you will need for the opening.

The documents you need will be determined by the type of account you want to open. However, some of the general documents are listed below.

- A completed account opening form.

- One passport photograph.

- Means of identification.

- Valid proof of residence.

- Utility bill.

These are the basic requirements needed to open an account in Account.

How to Open an Access Bank Account

We have outlined a guide on opening an Access bank account. Read below to see the steps.

Step 1: Research and Choose the Right Account for You

We said earlier that there are different types of bank account access. These accounts are for different purposes, so you have to research and then choose the type of account you need.

It would be best if you also considered your financial goals when choosing an account.

Step 2: Gather the Required Documents

Some necessary documents are needed to open an Access bank account, such as a passport, valid ID card, BVN, and utility bill. You have to get the documents ready before going to the bank to have a hassle-free account opening.

Step 3: Visit an Access Bank Branch or Apply Online

Once you have gotten the required documents ready, you should visit any Access bank close to your location to open an account, or you can apply online.

Upon arrival at the bank, a customer representative will give you forms to fill out and guide you through the process.

Step 4: Complete the Account Opening Process

You must complete the account opening process before creating your account, so you must exercise a little patience and fill out the account opening form with the correct information.

To avoid any issues in the future, you have to make sure what you fill out is correct.

Step 5: Activate Your Account and Start Banking

After you have completed the account opening, you can then activate your account by funding it, and then you can start banking.

FAQs

How Can I Open an Access Bank Account with My Phone?

To open an access bank account with your phone, dial *901*0#, then follow the guidelines. You can open an account with your BVN or provide your details as requested.

When you have provided the required details, you will receive an SMS with your new account number details.

Can I Open a Bank Account Online?

You can open a bank account online rather than going to the nearest branch. This straightforward process does not always require depositing money for the account opening.

What Are the Requirements Needed to Open an Access Account Online?

These are the requirements to open an account online.

- Access the mobile bank app.

- Email address.

- Mobile phone number.

- Address.

- Next of kin.

- Your Next of kin’s phone Number.

- Active internet connection.

- Smartphone.

With these requirements, you are set to go.

How Can I Open an Access Bank Account with a Phone and Code?

Another method of opening a hassle-free Access bank account is through its USSD Code. This method of account opening does not require an internet connection to work.

You need your mobile phone and your SIM card, then dial the Access bank account opening code *901*0# on your phone and follow the on-screen instructions.

What is the Code to Open an Access Account?

The code used in opening an Access bank account is *901*0#.

Can I Open an Access Bank Account Online?

Yes, opening an Access Bank account online through the Access Bank website is possible.

Conclusion

Access Bank offers many benefits to its clients, makes life more comfortable for them by expanding its banking operations, and allows them to access overdrafts and loans for their business at reasonable rates. And you can enjoy these benefits when you bank with Access.

Related Post;